With the increasing focus on AML, KYC and Fraud prevention by the regulators and authorities this edition of our newsletter throws the spotlight on the WILFr AML and Fraud module.

2019 looks set to be on course for a record number of AML fines, with $7.7 billion already handed out in January to April 2019, compared to $1.16 billion worth of fines in the same period last year.

The combined value of penalties given out so far in 2019 is more than 70 per cent of the total handed out in the whole of 2014 ($10.89 billion) – the year which currently holds the record for highest total value of fines.

It is nearly double the value of AML fines from the entire of 2018 ($4.27 billion), despite the number of penalties being roughly a third of the total for last year (nine in January to April 2019 versus 29 in 2018).

Recent analysis also showed that US-based regulators penalise institutions the most, followed by those in the UK.

Banks are still receiving the majority of penalties, but there is a growing focus on other sectors, such as legal, gaming and cryptocurrency.

At the same time as this increase the complexity of data checking required has increased with more and more countries creating beneficial ownership registers but with little improvement in terms of the quality of data published in sanction lists.

The WILFr AML and Fraud Prevention module provides a wide range of features to protect the Bank.

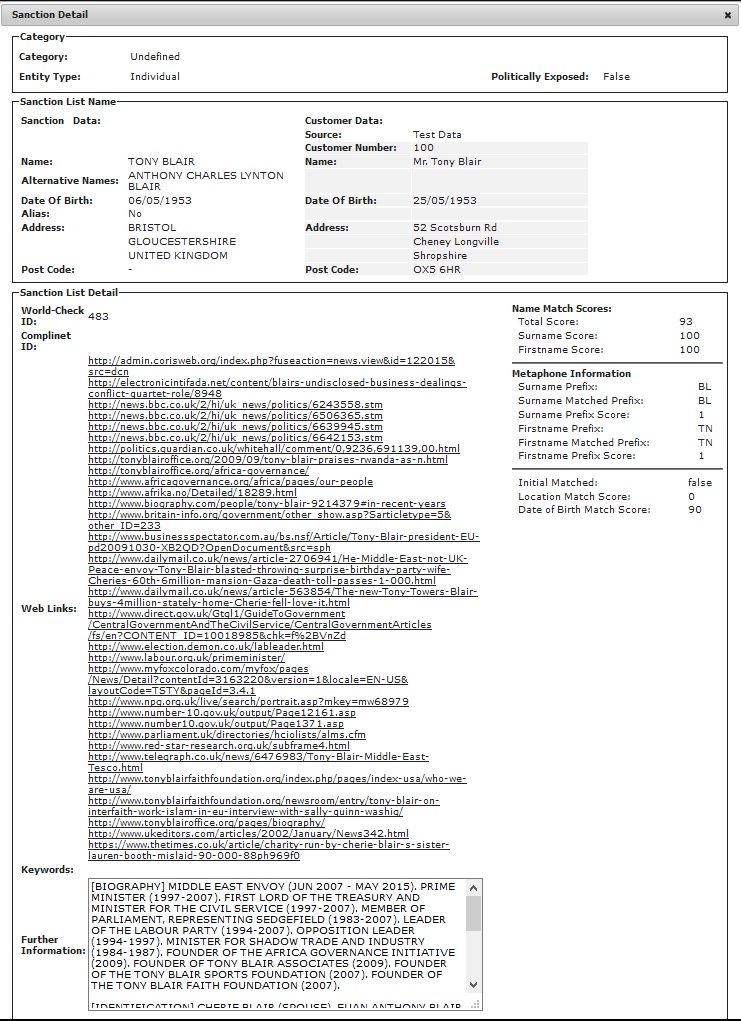

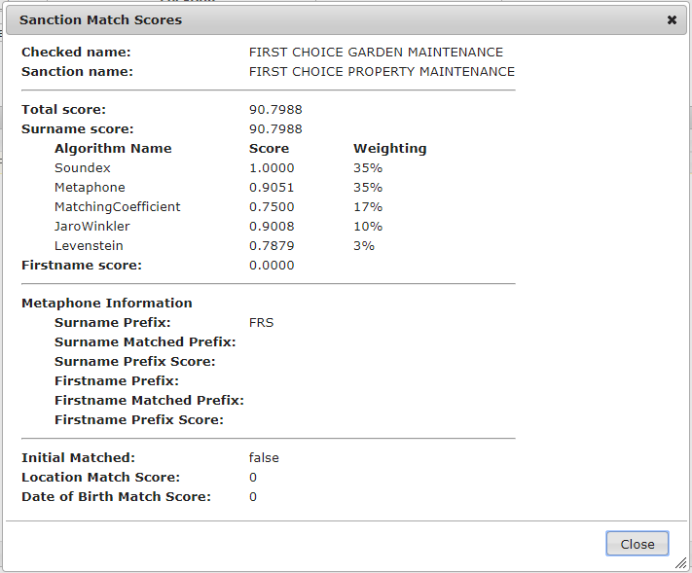

Example screens displaying a sanction hit and the sanction scores:

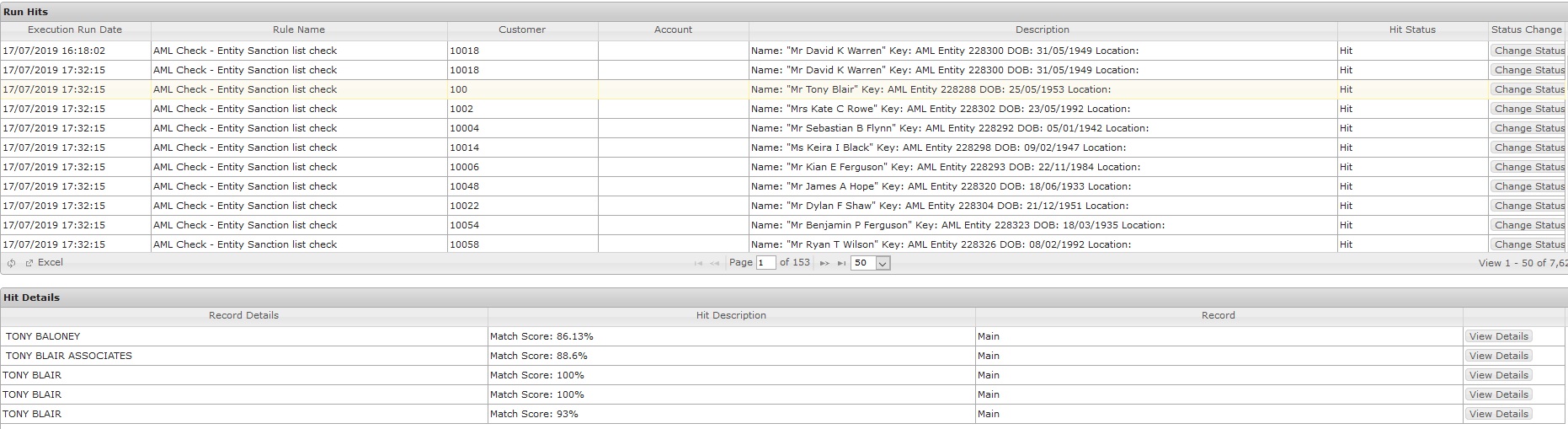

Example of the hit checker report:

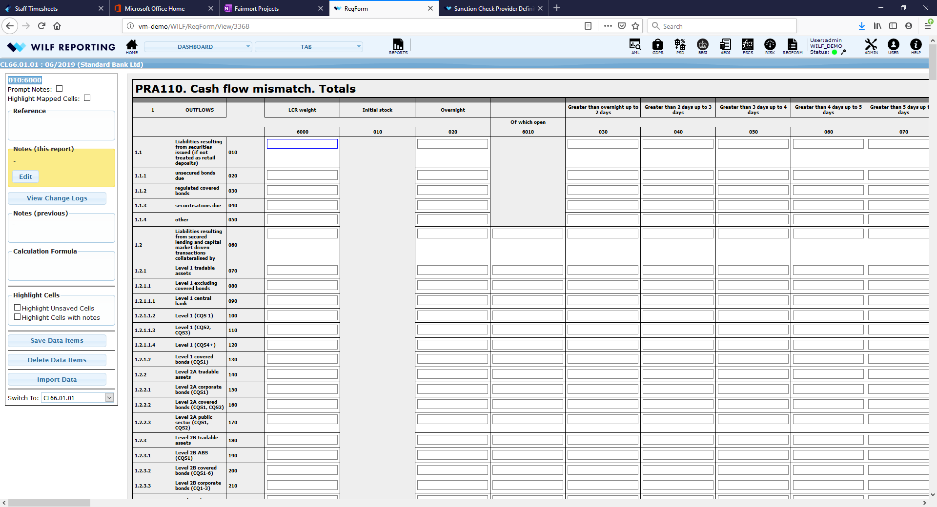

As with other regulatory reports, Fairmort provides the ability to generate, validate and export XBRL for PRA110. For each period a user can generate the PRA110 report and is then able to view the form in a friendly HTML interface within the WILFr Regulatory Reporting module. Once the report is generated a user can then import directly from the Excel file provided, reducing time adding data manually into the web form. After the data has been entered validation can be performed using the validation provided by the Bank of England, this will check the figures entered and ensure that any errors are caught. Once the user has successfully validated the report, the user can then export the report to XBRL ready for submission to Gabriel. Fairmort are also engaged in several projects for banks that are automating the population of the PRA reports, utilising the Logical Objects functionality. The PRA110 report became effective from July 2019. Fairmort also provides functionality for PRA101 – PRA109 reports.

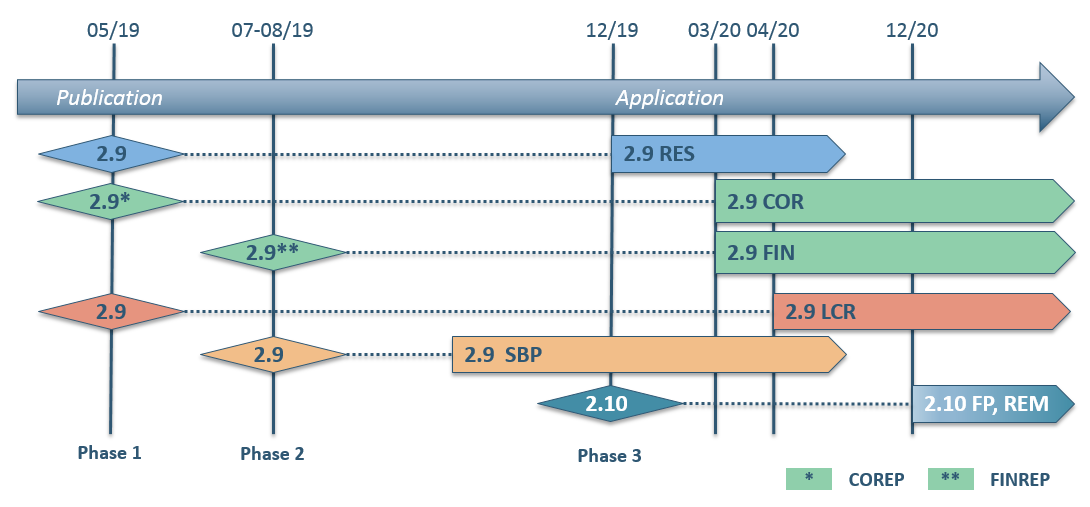

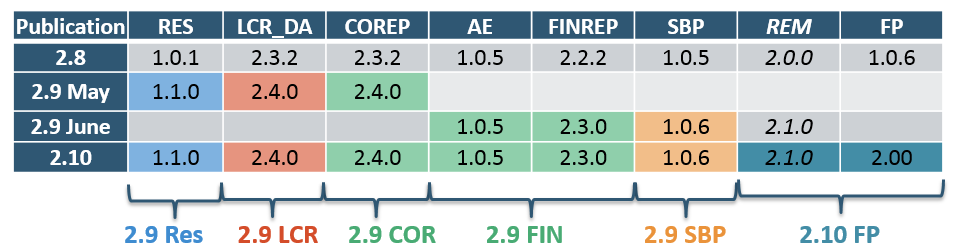

The EBA’s release plans for major updates to taxonomy in v2.9 that we reported in our December 2018 Newsletter, have since changed and the new release schedule should be noted. The EBA has also started to announce plans for the v2.10, which is scheduled to be released at the end of 2020. The following diagram shows the updated timetable:

Details of the taxonomy changes for some of the release packages have now been published, and Fairmort is preparing to update the WILFr reporting taxonomies for release to WILFr RegForm users in advance of the application dates in Q4 2019 and Q1 2020.

And the following table gives details of the new release schedule, also showing the updates announced in v2.10.

You can find full details of the EBA’s planned changes at the following link:https://eba.europa.eu/risk-analysis-and-data/reporting-frameworks/reporting-framework-2.9

We frequently monitor PRA announcements and publications and log them in our PRA tracker…

| Date | Topic | Ref | Other Ref | Report | Comment | Link to Webpage | |

|---|---|---|---|---|---|---|---|

| 07 June 2019 | PRA | Proposed discontinuation of FSA006 | CP 13/19 | FSA006 | We published CP13/19 ‘Occasional Consultation Paper’ which proposes the discontinuation of the FSA006 return. | Click Here | |

| 07 June 2019 | FCA | Overdraft Pricing and Competition Remedies | CP 19/18 | This Consultation Paper sets out further proposals on overdrafts as part of our review of high-cost credit. It should be read alongside PS19/16 High-cost Credit Review: Overdraft policy statement and CP18/42. | Click Here | ||

| 07 June 2019 | FCA | High-Cost Credit Review: Overdraft policy statement | PS 19/16 | In our Consultation Paper, CP18/42 (December 2018), we explained why fundamental reform was needed to the way banks charge for overdrafts. We proposed radical changes to the overdraft market to address harm from high prices for unarranged overdrafts, complex pricing structures, low consumer awareness and the repeat use of overdrafts. Our package of remedies to make overdraft pricing simpler, fairer and easier to manage has been widely supported. | Click Here | ||

| 07 June 2019 | FCA | Payment Services and Electronic Money - Final Guidance | New Guidance on authentication and secure communication under PSD2. Chapters affected 17 and 20. Minor changes to clarify our guidance or reflect legislative change. Chapters affected 1, 3, 6, 8, 13, 18, 19" | Click Here | |||

| 06 June 2019 | BoE | Form AS and Form FV updateThe first submission date for both forms remains 26 June 2019. | ASFV | The Bank of England is making a User Acceptance Testing (UAT) environment available for reporters to test Form AS and FV submissions in advance of making a legal submission to the Bank of England's Electronic Data Submission (BEEDS) portal. The dates have now been confirmed and the window will be available to firms from Monday 10 June to Friday 14 June 2019. | Click Here | ||

| 05 June 2019 | PRA/FCA | The PRA and FCA share key themes and good practice, and set out next steps for the transition from LIBOR | Risk Free Rates RFRs | Firms’ preparations for transition from London InterBank Offered Rate (LIBOR) to risk-free rates (RFRs): Key themes, good practice, and next steps | Click Here | ||

| 31 May 2019 | PRA | PRA110 Update | PRA110 | As part of our work on the Pillar 2 liquidity framework, including the introduction of PRA110 reporting by firms from 1 July 2019, we published Version 1 of the PRA110 liquidity metric monitor tool (PRA110 LMM tool). It is published to assist firms in the same way as the LMM for FSA047 and FSA048. It is for information only and must not be used to submit regulatory returns required by our rules. | Click Here | ||

| 30 May 2019 | PRA/FCA | FCA and PRA jointly fine Raphaels Bank £1.89m for outsourcing failings | The Financial Conduct Authority (FCA) and Prudential Regulation Authority (PRA) have fined R. Raphael & Sons plc (“Raphaels”) for failing to manage its outsourcing arrangements properly between April 2014 and December 2016. | Click Here | |||

| 30 May 2019 | FCA | Personal current accounts and overdrafts. | FCA 2019/71 | Personal Current Accounts and Overdrafts Instrument 2019. Effective date 18/12/2019 & 06/04/2020 | Click Here | ||

| 29 May 2019 | EBA | EBA technical standards The first reporting reference date will be 31 March 2020 for COREP changes, 30 April 2020 for changes regarding liquidity (LCR and ALMM) and 31 December 2019 for resolution planning. | ITS V2.9 | EBA publishes amended technical standards on supervisory and resolution reporting for EU institutions and the corresponding DPM and XBRL taxonomy 2.9 | Click Here | ||

| 02 May 2019 | EBA | Counterparty Risk - Consultation Paper | SA-CCR | The European Banking Authority (EBA) launched today a consultation on four draft Regulatory Technical Standards (RTS) on the Standardised Approach for Counterparty Credit Risk (SA-CCR). These draft technical standards specify key aspects of the SA-CCR and represent an important contribution to its smooth harmonised implementation in the EU. The draft technical standards were developed based on the mandates included in the latest available version of proposed amended Capital Requirements Regulation (CRR2). The consultation runs until 2 August 2019 | Click Here | ||

| 07 May 2019 | FCA | Consultation on mortgage advice and selling standards | CP19/17 | This Consultation Paper (CP) contains proposals for changes to our mortgage advice and selling standards to address 3 harms identified through the Mortgages Market Study (MMS): • our advice rules and guidance are a barrier to the development of tools to help consumers choose and buy a mortgage • consumers who would like to buy a mortgage on an execution-only basis find it hard because they are diverted to advice and because execution-only sales channels are not always easy to use • many consumers are overpaying for their mortgages, even when they get advice | |||

| 01 May 2019 | PRA | PRA110 Update | PRA110 | 1 May 2019: There are two months to go until the implementation of PRA110 on 1 July 2019 and the commencement of the dual reporting period with FSA047 and FSA048. Firms are advised to continue to familiarise themselves with the policy, template and instructions. For the full update see the ‘Reporting of PRA110’ section. | Click Here | ||

| 01 May 2019 | PRA | Systemic Risk Buffer rates for ring-fenced banks and large building societies | The PRA is required by the Capital Requirements (Capital Buffers and Macro-prudential Measures) Regulations 2014 as amended by Capital Requirements (Capital Buffers and Macro-prudential Measures) (Amendment) Regulations 2015 (Part 5A) to set Systemic Risk Buffer (SRB) rates for ring-fenced banks (RFBs) and large building societies from 1 January 2019 by applying the Financial Policy Committee (FPC)’s framework for the SRB. The PRA has set out its approach to the implementation of the SRB in 'The PRA’s approach to the implementation of the systemic risk buffer' (December 2018). | Click Here | |||

| 30 April 2019 | PRA | Operational continuity in resolution. (For firms impacted by Operational Continuity part of the PRA rulebook) | PS 10/17 | PRA109 | In Policy Statement 10/17, ‘Ensuring operational continuity in resolution: reporting requirements’ we committed to confirming the precise mechanism by which the PRA109 ‘Operational continuity’ data would be collected. We confirm that this data will be collected via Excel. For the Excel template, related instructions, and submission deadline | Click Here | |

| 24 April 2019 | FCA | Supervisory principles amendment. | FCA 2019/67 | The Financial Conduct Authority makes this instrument in the exercise of the powers in section 139A (Power of the FCA to give guidance) of the Financial Services and Markets Act 2000. | Click Here | ||

| 18 April 2019 | PRA | Non-binding PRA materials: The PRA’s approach after the UK’s withdrawal from the EU | SS1/19 | HM Treasury set out its intention to ensure that the UK continues to have a functioning financial services regulatory regime regardless of the outcome of negotiations with the EU. This approach is to ensure that EU-derived laws and rules that are currently in place in the UK will continue to apply at the point of exit to the extent that they remain operable in a UK regime. Changes will only be made to those laws or rules that would otherwise not operate appropriately. This provides continuity and certainty for firms as the UK leaves the EU. This supervisory statement (SS) elaborates on how firms should interpret existing non-binding PRA regulatory and supervisory materials in light of the UK’s exit from the EU. This includes the PRA’s existing approach documents, statements of policy (SoPs), and SSs – these are collectively referred to as the PRA’s ‘non-binding materials’. | Click Here | ||

| 18 April 2019 | PRA | PRA approach to interpreting reporting and disclosure requirements and regulatory transactions forms after the UK’s withdrawal from the EU | SS2/19 | This supervisory statement (SS) sets out the approach the Prudential Regulation Authority (PRA) expects firms to take when interpreting EU-based references found in reporting and disclosure requirements and regulatory transactions forms after the UK’s withdrawal from the EU. The PRA has not made line-by-line changes to reporting or disclosure requirements, or regulatory transactions forms, as a result of the UK’s withdrawal from the EU, as it would not have been proportionate to do so. Instead, the PRA expects firms to interpret EU references in those templates and instructions in accordance with this SS. | Click Here | ||

| 18 April 2019 | PRA | Depositor and dormant account protection | SS18/15 | PS5/19 | A final updated version of SS18/15 was published to reflect a no-deal withdrawal from the EU as part of joint Bank of England and PRA Policy Statement 5/19 ‘The Bank of England’s amendments to financial services legislation under the European Union (Withdrawal) Act 2018’, to deliver the general approach being taken to ensure there is a functioning legal framework when the UK leaves the EU. This SS is effective from the date of the UK’s withdrawal from the EU. | Click Here | |

| 17 April 2019 | FCA | Business Plan 2019/20 | Our Business Plan sets out our main areas of focus for 2019/20. It outlines our priorities and describes our response to the issues we have identified. It covers our supervisory priorities as well as market studies and the policy work we undertake. This enables industry and consumers to understand the entirety of our work in their sector and what they can expect from us in the coming year. | Click Here | |||

| 15 April 2019 | PRA | The Prudential Regulation Authority’s approach to enforcement: statutory statements of policy and procedure | SoP | The PRA published ‘The PRA investigation referral criteria’ and ‘Regulatory investigations guide’ on The PRA’s statutory powers webpage. | Click Here | ||

| 08 April 2019 | PRA | Consultancy Paper - Supervising International Banks: Revision of the branch return | CP 8/19 | Branch Return | In this consultation paper (CP), the Prudential Regulation Authority (PRA) sets out its proposals for changes to the format and content of the Branch Return Form (the Return), and additional guidance to assist firms in completing it. This CP is relevant to all existing and prospective PRA-supervised branches of deposit-takers and designated investment firms which are not UK headquartered firms (‘international banks’). | Click Here | |

| 01 April 2019 | PRA | PRA110 Update | PRA110 | 1 April 2019: There are three months to go until the implementation of PRA110 on 1 July 2019 and the commencement of the dual reporting period with FSA047 and FSA048. Firms are reminded to refer to the most recent Q&As on the template and instructions, and submit any questions that are not covered to their PRA supervisor, and copy in LiquidityPillar2ReportingProjectQueries@bankofengland.gsi.gov.uk. Firms are also advised to continue to familiarise themselves with the policy, and template and instructions, to prepare for implementation on 1 July 2019. | Click Here | ||

| 26 March 2019 | FCA | Consultancy Paper - Mortgage customers: proposed changes to responsible lending rules and guidance | CP 19/14 | We are proposing changes to our rules to reduce regulatory barriers to consumers who are up-to-date with payments and not looking to borrow more switching to a more affordable mortgage. | Click Here | ||

| 29 March 2019 | FCA | Brexit Update | Our final Handbook and Binding Technical Standards (BTS) instruments have now been made by the FCA Board and we have posted PDFs of each of these here. A number of the BTS instruments which we published as near-final in PS19/5 ‘Brexit Policy Statement: Feedback on CP18/28, CP18/29, CP18/34, CP18/36 and CP19/2’ have not yet been made by our Board and so are not yet available in final form. This is because these instruments must be made by the Prudential Regulation Authority before they can be made by our Board. This is due to take place in April, before exit day, and so we will publish these instruments in due course. We have also published our guidance on EU non-legislative materials, non-Handbook material and forms. These documents can be found on the FCA website at: https://www.fca.org.uk/publication/corporate/brexit-our-approach-to-eu-non-legislative-materials.pdf https://www.fca.org.uk/publication/corporate/brexit-our-approach-to-non-handbook-guidance.pdf https://www.fca.org.uk/publication/corporate/guide-to-completing-our-forms-after-brexit.pdf We are unable to publish the changes made by our Handbook and BTS instruments into the online Handbook until we have a confirmed date for the UK’s withdrawal from the EU. We will publish another update when we go live with these changes in the online Handbook. | Click Here | |||

| 28 March 2019 | UK Finance | White Paper - The ethical use of customer data | We are seeing growing interest among regulators, businesses, MPs, think tanks and the media in how data is used or ‘data ethics’. Among all these actors, there is recognition that we need to ensure that innovation in data analytics and artificial intelligence (AI) is used in ways that benefit consumers and society. For example, recently we have seen: The publication of the first two-year strategy of the Centre for Data Ethics and Innovation The publication of the Furman review (though this looked at a broad suite of issues, including competition) The European Commission’s high-level expert on artificial intelligence issued a consultation on ethical AI guidelines | Click Here | |||

| 26 March 2019 | FCA | Mortgages Market Study | MS 16/2 | In March 2019, we published our final report. The final report sets out our vision for the mortgages market as one in which: borrowers who can afford a mortgage can choose suitable and good value products and services firms have a culture of treating all customers fairly competition and proportionate regulation empower consumers to make effective choices before taking out, and throughout life of, a mortgage The report explains our final findings on whether the competition in the mortgage market works for the benefit of consumers. It also includes an update on remedies. | Click Here | ||

| 20 March 2019 | FCA/PRA | PRA and FCA agree Memorandum of Understanding (MoUs) with EBA (n-desl scenario) | The template sets out the expectations for supervisory cooperation and information-sharing arrangements between UK and EU/EEA national authorities. Following agreement on the template, the UK authorities and EU/EEA national authorities intend to move swiftly to sign bilateral MoUs. These bilateral MoUs will allow uninterrupted information-sharing and supervisory cooperation in the event of a no-deal scenario. | Click Here | |||

| 19 March 2019 | FCA | Pillar 2 Liquidity - Updates to the framework CP | CP 6/19 | In this Consultation Paper (CP), the Prudential Regulation Authority (PRA) sets out proposals for regulatory reporting amendments and clarifications to the Pillar 2 liquidity framework. The proposed changes would be implemented through amendments to: the Regulatory Reporting Part of the PRA Rulebook; (Appendix 1); Statement of Policy (SoP) ‘Pillar 2 Liquidity’ (Appendix 2); Supervisory Statement (SS) 24/15 ‘The PRA’s approach to supervising liquidity and funding risks’ (Appendix 3); SS34/15 ‘Guidelines for completing regulatory reports’ (Appendix 4); PRA110 reporting template (Appendix 5); and PRA110 reporting instructions (Appendix 6). This CP is relevant to UK banks, building societies, PRA-designated investment firms, and non-EU EEA banks. | Click Here | ||

| 05 March 2019 | EBA | EBA launches consultation to update Guidelines on harmonised definitions and templates for funding plans of credit institutions | CP | The European Banking Authority (EBA) launched today a consultation on the updated Guidelines on harmonised definitions and templates for the reporting of funding plans. This update is the result of the experience gained through the EBA's assessment of banks' funding plans in 2017 and 2018 as well as the questions raised via the EBA Single Rulebook Q&A tool. The consultation runs until 5 May 2019. | Click Here |

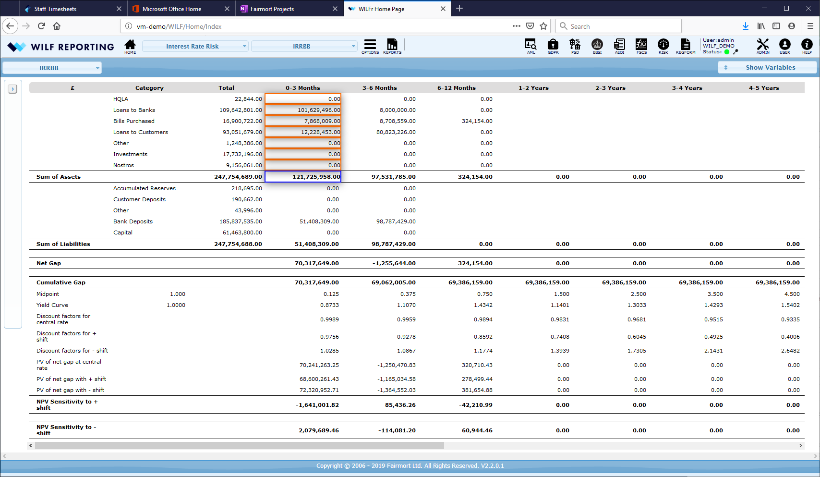

As part of the v2.2 release the front-end has been redesigned to provide more space on the page and to improve accessibility to all components and reporting.

The toolbar continues to provide immediate access to all dashboards and tabs, but now reports and components can also be accessed with increased ease.

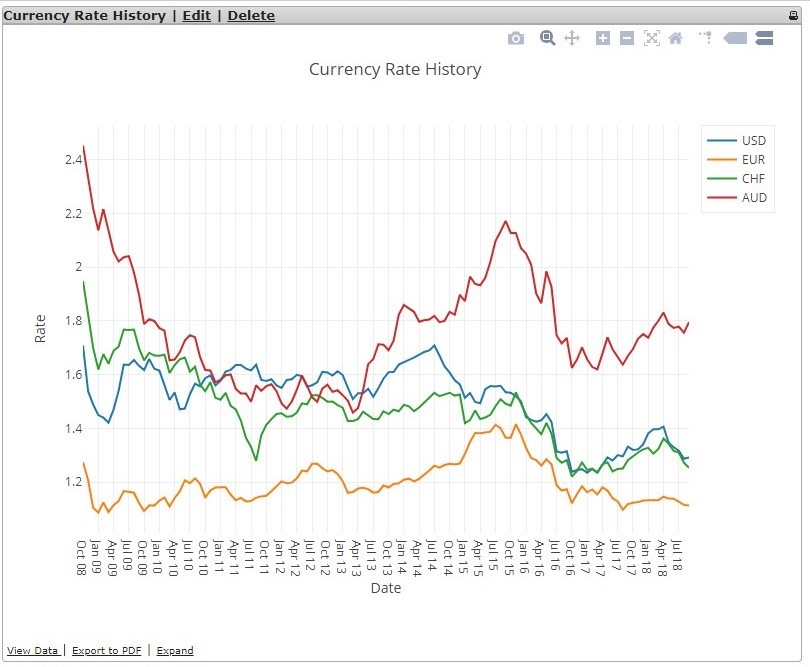

As part of our continual drive to improve WILFr we have incorporated an enhanced, modern charting framework that will improve the presentation of data on the website. Since the new charting framework will sit alongside the existing framework, charts built using the previous framework will continue to be supported.

The new charting tools promise to offer a more dynamic and faster user experience. More than 30 chart types are available, with in-browser features such as zoom, pan and hover, plus other dynamic features to allow users more meaningful interaction with their data. For advanced users there will be complete control over presentation through editing of the coded definition of the chart.

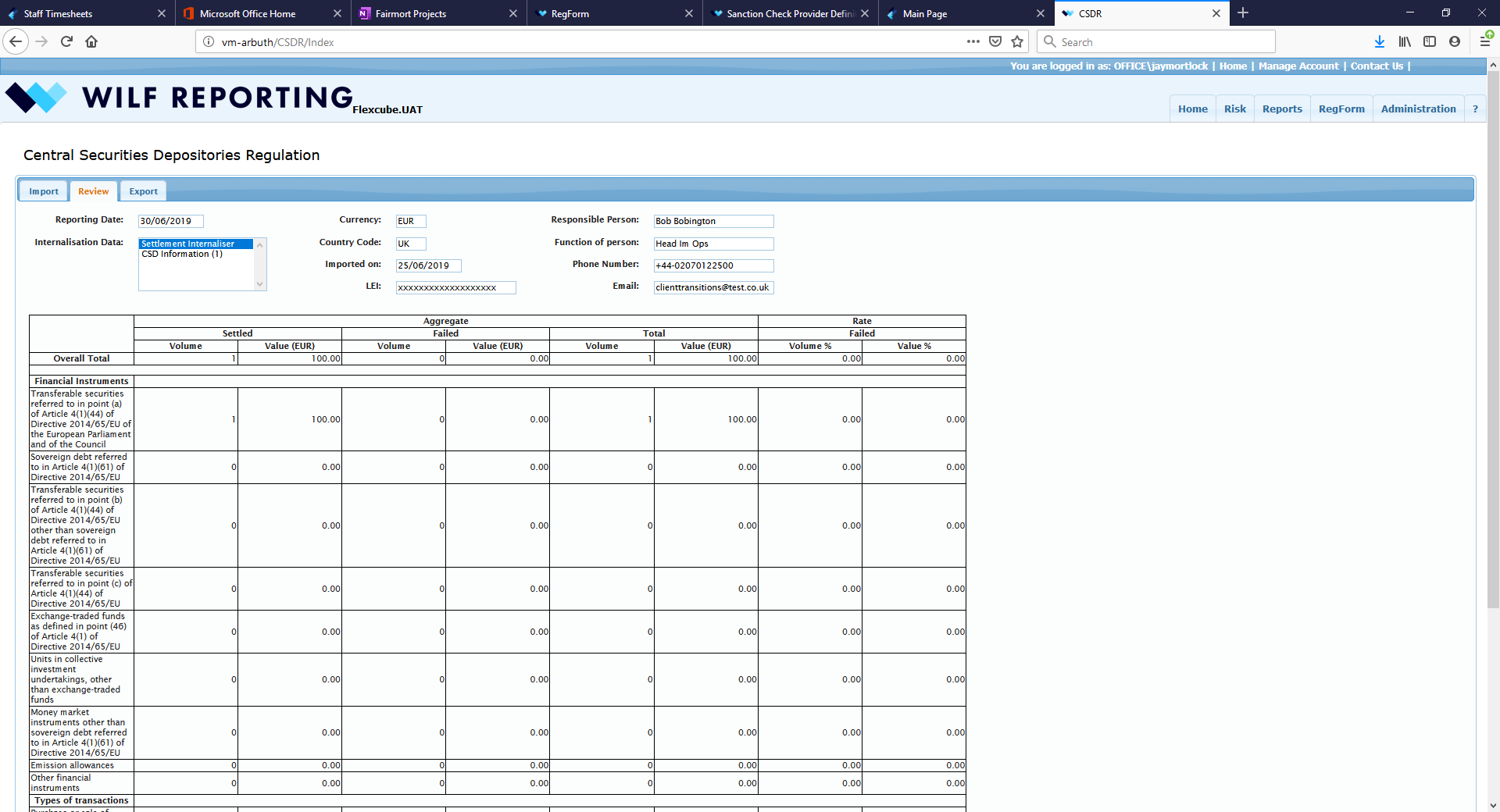

The CSD regulation was introduced in the aftermath of the financial crisis to harmonise the rules across Europe and to increase the security and safety of security settlement. As part of these regulations a new reporting requirement has been introduced (internalised settlement reporting). As a number of other regulatory reporting vendors are not offering a solution, Fairmort were required to provide a solution, at short notice, to enable WILFr clients, who were impacted by this regulation, to be able to comply with the first submission date of 12th July.

If you are affected by this regulation, then please contact Fairmort to discuss the solution available within WILFr.