The Competition and Markets Authority (CMA) investigation into the UK retail banking market published in August 2016 concluded that the older, larger UK banks did not compete hard enough for customer's business, whereas the smaller, newer banks find it difficult to grow and access the market.

The nine largest current account providers (AIB Group (UK) Ltd, Bank of Ireland (UK) Plc, Barclays Bank Plc, HSBC, Lloyds Bank Plc, Nationwide, Northern Bank Ltd (trading as Danske Bank), Royal Bank of Scotland Plc and Santander UK Plc), were mandated to introduce Application Programming Interfaces (APIs), data structures and security architectures that make it easy and safe for customers to share their financial records with third parties in a secure and standardised way, known as open banking.

On 13th January 2018 the gradual rollout of these services began, two months later and the FCA website already lists 19 Account information Service Providers (AISPs) and 3 Payment Initiation Service Providers (PISPs), however companies offering these services prior to 12th January 2016 don't need to be authorised by the FCA until the end of 2019 which is rather confusing for consumers. Whilst many of the companies are newcomers to this area, there are names such as Intuit who have been operating in this area for many years.

For personal customers the new open banking services will provide the ability to supply third parties with data that may facilitate the offer of a more cost-effective product, whether that is a loan, an overdraft, or even, potentially (with some additional data), other products, such as insurance or mobile phone contracts. It will allow customers to use money management apps to analyse their spending across multiple banking providers and to make payments directly from a current account without using the Visa, Mastercard, or other payment networks. It's attractive to retailers to be able to by-pass the current processing fees charged by these providers.

For business customers the benefits are similar with regards to obtaining faster and better financing terms but will also allow accounting software to obtain transaction history information in a standard manner, to pre-populate company financial records and to automatically forecast future cashflows based on experience of payments and receipts.

The nine banks forced by the CMA to provide APIs will be joined by others on a voluntary basis who want their customers to be able to take advantage of their open environment ahead of the EU's PSD2 regulations, which will make this mandatory for all current account providers. Both Monzo and Starling Bank have taken this step, as well as P2P lender, Zopa, who is in the process of obtaining a full UK banking licence. Tandem, a Fairmort customer, is offering an app that allows consolidation of transactions from 14 providers including Amex, Barclaycard, Capital One, Tesco Bank and TSB alongside their own product offerings of a credit card and fixed term savings account.

HSBC has announced that they will be launching their open banking app in April which will allow their customers to consolidate information from other banks, suggesting that the new entrants won't have the market to themselves for long and it would be surprising if Barclays are far behind, despite struggling to meet the initial deadline.

Meanwhile, the CMA has given The Bank of Ireland until September to provide the APIs after missing the original deadline and Cater Allen, a Santander subsidiary has been given until January 2019.

As the PSD2 deadline gets ever nearer, the UK open banking initiative is starting to provide an insight into the bigger shake-up - the PSD2 regulations will cause across European banking services.

The management of Interest Rate Risk in the Banking Book (IRRBB) has become more and more complex with the European Banking Authority (EBA) guidelines and the Basel Committee for Banking Supervision (BCBS) 368 requirements. Recognising this challenge to the banking community, Fairmort is developing a suite of screens and reports that assist banks to manage this risk and to provide banks with the flexibility to tailor the screens to their own unique business requirements. The solution has been built within our new Logical Object Reporting framework, which is a comprehensive technical framework for organising and standardising data types and data structures from one or multiple sources. Using Logical Object Reporting allows the IRRBB report to be deployed strategically into financial reporting areas, often replacing complex spreadsheet solutions.

For further information on IRRBB or to arrange a demo please contact Clive Bowles – Clive.Bowles@fairmort.com

Established in 1994, PCF Group Plc has helped more than 70,000 customers to finance their vehicles, plant and equipment. Their success in this area is based on two propositions: that finance should be easily understood, and that a high level of customer service is part of the product. In July 2017, PCF Group successfully launched PCF Bank, bringing those same principles into the savings market, where they now offer a range of competitive products and a truly outstanding service.

The launch of PCF Bank meant that PCF Group has been able to significantly reduce its costs in raising of capital for its consumer and asset finance businesses.

Fairmort began working with PCF in April 2014 with the process of selecting the various IT components required for the launch of the bank. A full requirement gathering, and a request for proposal process was carried out and in early 2015 the bank made its decision to select the T24 package from Temenos and the BankFast internet banking / on-boarding solution from Sandstone. The banking licence application was approved in December 2016. SOFGEN carried out the implementation of the T24 system, Sandstone implemented the BankFast solution and Fairmort was able to assist PCF Bank through the implementation of its Fast-Fuse and WILF Reporting solutions.

Fairmort's Fast-Fuse is a set of configurable interfacing tools and utilities that allow integration between different systems to be achieved quickly but in a robust manner. This tool has been developed based on 20+ years of experience of connecting systems with core banking systems. At PCF Bank, Fast-Fuse was implemented as the message router between Sandstone's BankFast Online platform and Temenos's T24 core banking platform, for online banking operations. Fast-Fuse was also implemented as the message router between Sandstone's BankFast Apply platform and Temenos's T24 core banking platform, for customer onboarding.

PCF Bank launched its savings products to personal customers initially, with an initial soft launch for friends-and-family on 22 May 2017, followed by the full launch on 24 July. The implementation was well within the PRA's 12-month mobilisation timeframe. PCF Bank is planning to launch deposit products for non-personal customers in 2018.

Fairmort's WILF Reporting solution has been implemented as the central data warehouse to facilitate PCF's Regulatory Reporting (AEOI, FSCS, BBSI and COREP), general management information requirements, WILF Companies House Checker, plus some specialist functions, including integrating with Vix Verify which provides an on-going sanctions list checking service. Data is imported from various systems, including T24, Microsoft Dynamics and Sopra's Instalment Credit Suite.

Speaking of PCF Bank's experience with the Fairmort team and Fairmort's products, PCF Bank's Finance Director, David Bull said:

"The Fairmort team worked closely with both our team and other vendors and was instrumental in designing and delivering the end-to-end integration for the customer onboarding and online banking platform. When challenges were faced, Fairmort went to great lengths to find a workable solution, keeping the project on track in terms of time and costs. Fairmort's solutions have proven to be robust, high quality, rich in functionality and of great value."

To ensure our software is compliant with the latest regulations we proactively research regulatory changes monthly. These changes may have an impact on your business.

The section on lawful basis for processing contains new expanded guidance. The legislation also expands on legitimate interests, special category data and criminal offence data, plus an updated section about consent.

A new template has been provided for data documentation, which while not enforced, gives guidance about how banks should be documenting their data, and the considerations they should make.

More details can be obtained via the useful, new website, called What's New?

| Date | Topic | Ref | Other Ref | Report | Comment | Link to webpage | |

|---|---|---|---|---|---|---|---|

| 23 Feb 18 | FCA | Consumer Credit (earlier intervention & persistent debt) 2018 | FCA 2018/7 | Effective 1/3/2018 | Click Here | ||

| 23 Feb 18 | FCA | Financial Crime Report (Amendment) 2018 | FCA 2018/5 | Click Here | |||

| 23 Feb 18 | PRA | Pillar 2 Liquidity | PS 2/18 | SS24/15 | PRA110 | Final templates. Effective Jul 19 | Click Here |

| 31 Jan 18 | PRA | Minor updates to PRA102 & PRA103 instructions | PRA102PRA103 | Click Here | |||

| 22 Jan 18 | FCA | Client money and unbreakable deposits | PS 18/2 | CP 17/9 | N/A | Click Here | |

| 18 Jan 18 | FCA | Consultancy paper issued FSCS Management Expenses Levy | CP 18/2 | N/A | Click Here | ||

| 17 Jan 18 | PRA | Pillar 2 Liquidity | CP13/17 | PRA110 | Postponed implementation from 01/19 to 07/19 | Click Here | |

| 20 Dec 17 | PRA | Int'l banks - PRAs approach to branch authorisation and supervision (27/02/18) | CP 29/17 | ||||

| 15 Dec 17 | PRA | Updated timeline for Capital+ reporting | Capital + | Click Here | |||

| 12 Dec 17 | FCA | Information about Current Account Services | PS17/26 | ||||

| 11 Dec 17 | PRA | Issue of SS 9/17 | SS 9/17 | Includes recovery plan information template | |||

| 06 Dec 17 | PRA | CP issued - Pillar 2 update to reporting requirements (06/03/2018) | CP 25/17 | ||||

| 06 Dec 17 | PRA | CP issued - Model risk management principles for stress testing (06/08/2018) | CP 26/17 |

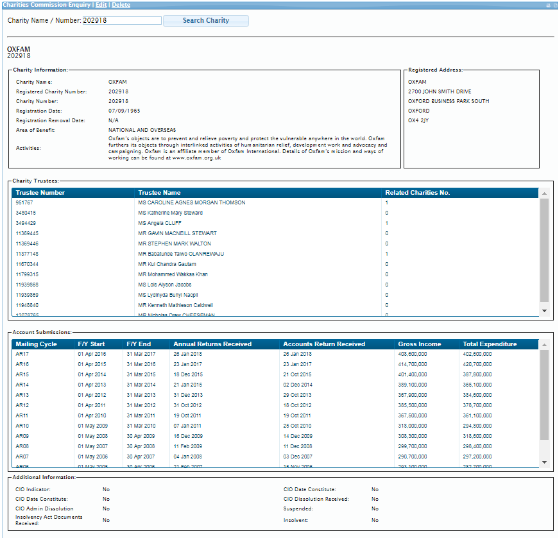

To complement our Companies House checker we have developed a Charities Commission checker using an API to return real-time data. This data can be used to automatically compare against your existing data so that your due diligence on customers is maintained to a satisfactory standard as well as assisting in on-going AML checks.

Both the Charities Commission and Companies House checkers are fully integrated with the Exceptions dashboard.

HMRC made a clarification regarding undocumented accounts being reportable regardless of jurisdiction and other small enhancements.

PGP encryption is now supported in v1.1, although a workaround is still available. Other small enhancements are also included as is full integration of FSCS data validation with the Exceptions dashboard.